LEADING CONSULTANCY BOOSTS ADVISORY AND RESEARCH TEAMS WITH SENIOR APPOINTMENTS OF PLUNKETT AND O’GRADY AND PROMOTION OF KIRWAN

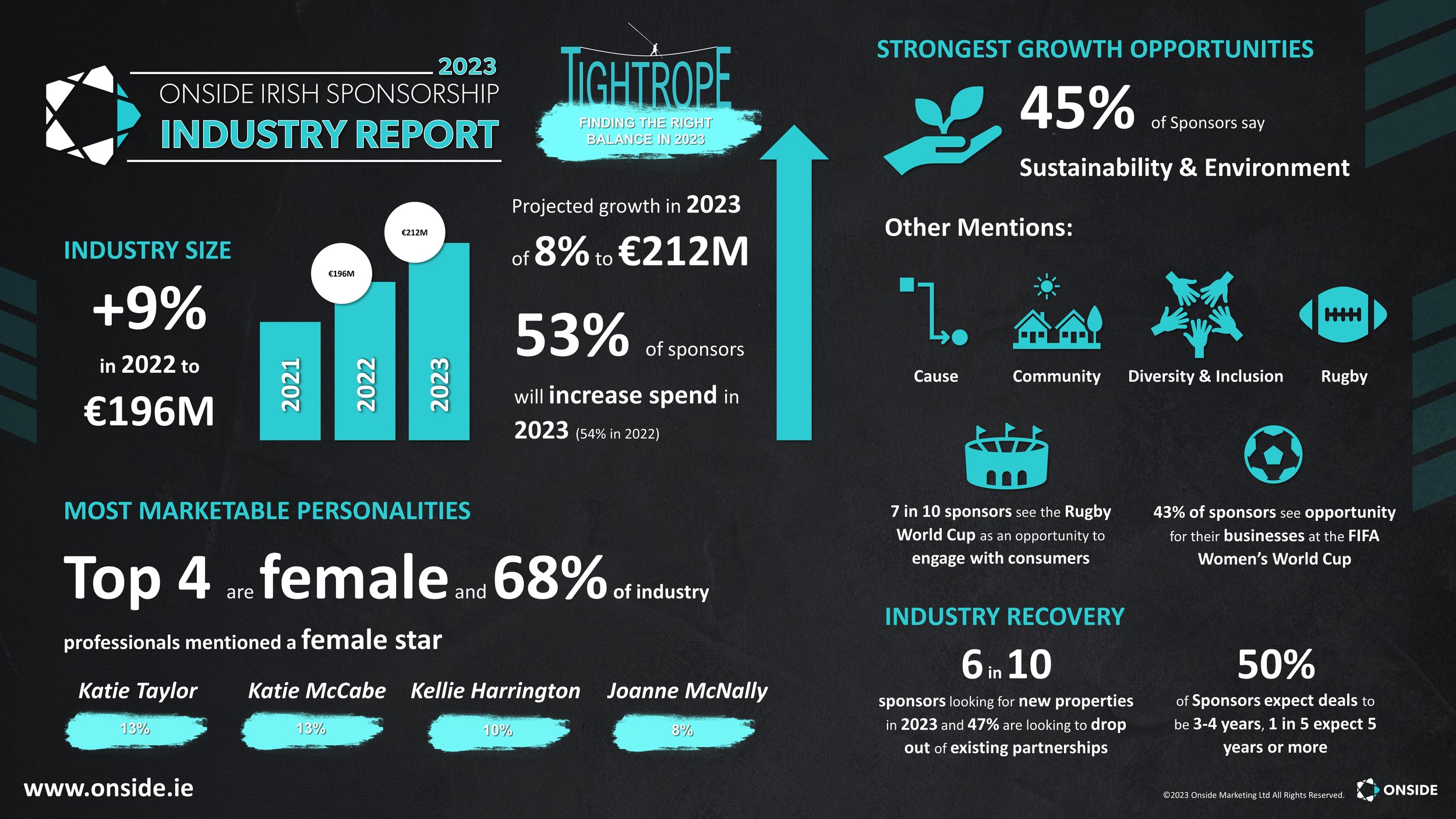

With the Irish sponsorship industry expected to see growth of 8% in 2023 to €212m, new research from specialist consultancy ONSIDE uncovers a significant 20% increase in the portion of Irish consumers who would like to see companies in Ireland increase or maintain their investment in sports sponsorship since the start of the pandemic.

In spite of the cost-of-living crisis and its impact on the Irish economy and society, 7 in 10 adults think sponsors should increase or maintain their spend in sports in general, sports events and teams, with increases of 18% to 20% since 2020. This enthusiasm for sports is matched by support for increasing or maintaining levels of sponsorship of arts and cultural events, up 17% since 2020.

“These are really positive signals for the sponsorship sector. People increasingly want businesses to support the organisations and institutions they care about in such uncertain times” says ONSIDE Founder and Chief Executive, John Trainor.

“Maintaining investment in sponsorship can feel like walking a tightrope when the economy is struggling but these findings have inspired us to invest new energy in strengthening our team and services.”

This new energy includes expanding the ONSIDE Advisory Team with the appointment of Áine Plunkett as Head of Advisory. Áine joins ONSIDE from SSE Airtricity where she was Head of Brand, Advertising and Sponsorship across Great Britain and Ireland.

Áine Plunkett, Head of Advisory, ONSIDE

Trainor says: “Áine is an award-winning marketer who has been responsible for some of the most innovative and impactful sponsorships in Europe. She will bring a fresh perspective to our work in Ireland as well as supporting our international growth.”

“ONSIDE has a unique reputation for providing the intelligence that fuels many of the most successful and enduring sponsorships in Europe and I’m really looking forward to becoming part of the team,” adds Plunkett.

Áine will be complemented on the advisory team by Senior Consultant, Ciara O’Grady, who joins ONSIDE from the Gleneagle Group where she was Director of Arts, Innovation and Corporate Services, giving ONSIDE a presence in Munster to complement its Head Office in Dublin and base in London.

“From our Annual Industry Report, Quarterly Sponsorship Review and daily intelligence-gathering to bespoke studies for clients, we know that exceptional research is a key enabler of positive outcomes. Kim Kirwan is an outstanding leader of our growing intelligence team and has been promoted to Director of Intelligence and Insights in recognition of her contribution to date and the opportunities we see to provide further support to the industry,” adds Trainor.

REQUEST FINDINGS FROM THE ONSIDE IRISH SPONSORSHIP INDUSTRY REPORT 2023