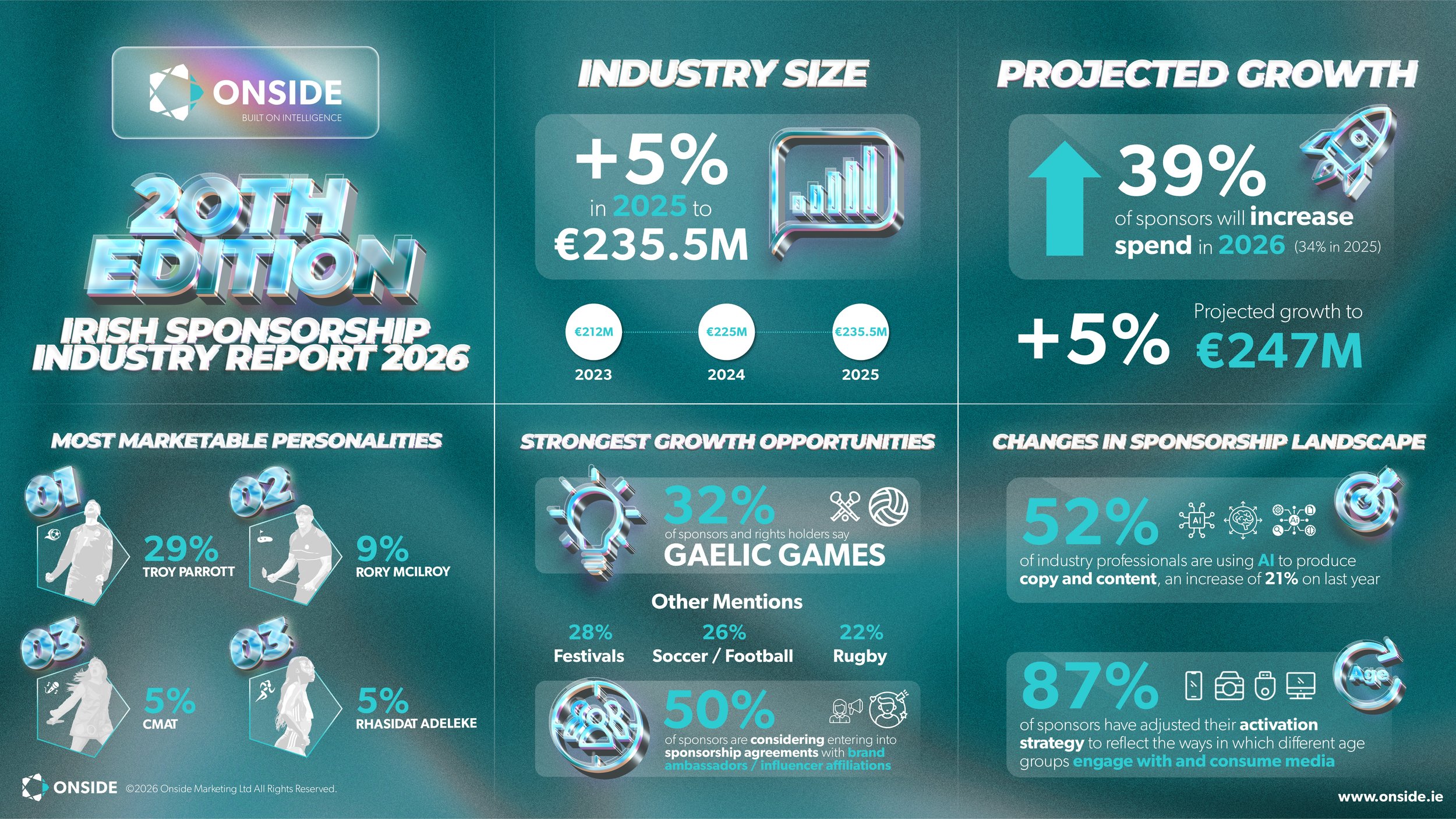

The Irish sponsorship market, valued at €235.5 million in 2025, is projected to rise by 5% to €247 million in 2026, according to the 20th edition of the annual ONSIDE Irish Sponsorship Industry Survey.

At the end of 2024 34% of sponsors predicted an increase in sponsorship spend for 2025 but in hindsight 57% of sponsors reported increasing their spend during the year. Looking forward to 2026 the momentum is set to continue with 39% planning to increase spend further in the year ahead compared to 18% anticipating a reduction.

Demand for sponsorship properties remains resilient with 4 in 10 sponsors considering new sponsorships, however, exit intentions have risen. Following an historic low of 23% last year, 36% of industry professionals now intend to exit a sponsorship agreement signalling an increasingly active landscape for 2026.

Key trends shaping the sponsorship industry:

In 2025, ONSIDE tracked a record number of brand ambassador deals. The number of deals doubled that of the previous high set in 2022, with the trend projected to continue in 2026 as 50% of sponsors are considering entering brand ambassador/influencer affiliation agreements. “The landscape is evolving with brands harnessing personalities who can build and sustain an audience, not just those who perform on their respective sporting field” says Kim Kirwan, Director of Intelligence and Insight at ONSIDE. “The talent pool is widening beyond the worlds of sport and entertainment to include content creators, with brands favouring those personalities who can connect with audiences and maintain relevance throughout the year and not just during sporting moments”.

Moreover, recent public research produced by ONSIDE alongside the industry survey, underscores the influence of these personalities on younger audiences. Aligning with a brand resonates strongly among the under 25’s with 68% saying it is a good idea for companies to do this whilst 77% of under 25’s recognise influencer/personality endorsements of brands/companies as an effective form of sponsorship.

The Sponsorship industry is increasingly adopting and integrating AI into various aspects of their sponsorship activities. At present, it’s primarily used to produce copy and content while data analysis is the leading intended use with nearly 4 in 10 planning to try it for the first time in 2026. As the industry navigates the nuances of AI, social media remains a cornerstone for sponsorship activation with nearly 8 in 10 sponsors expecting to use it more in 2026.

2025 also marked the rise of beauty brands in the Irish sponsorship landscape, influenced by a similar trend occurring in international markets. The rising prominence of beauty products and personal care brands, coupled with an increasing desire for premiumisation, has prompted the emergence of a distinct beauty category. In 2026, we can expect both local and international beauty brands to look for opportunities across various industry entry points, from individual player partnerships to category leagues and competition associations. For rights holders though, the challenge will be to create attractive packages for this emerging and exciting category.

Kirwan concludes, “the overall health of the sponsorship market remains strong; however, growth has brought complexity. The sponsorship landscape is now more fragmented, both in terms of the range of assets and properties available and the ways in which audiences engage with content across multiple platforms. As a result, engaging, well-executed activations that span multiple media channels are increasingly critical. At the same time, return on investment has become a growing concern for sponsors, placing greater emphasis on measurement, accountability and strategic alignment. In this environment, the most successful sponsorships are those that combine creativity with clarity of purpose, ensuring investment delivers tangible and measurable value”.